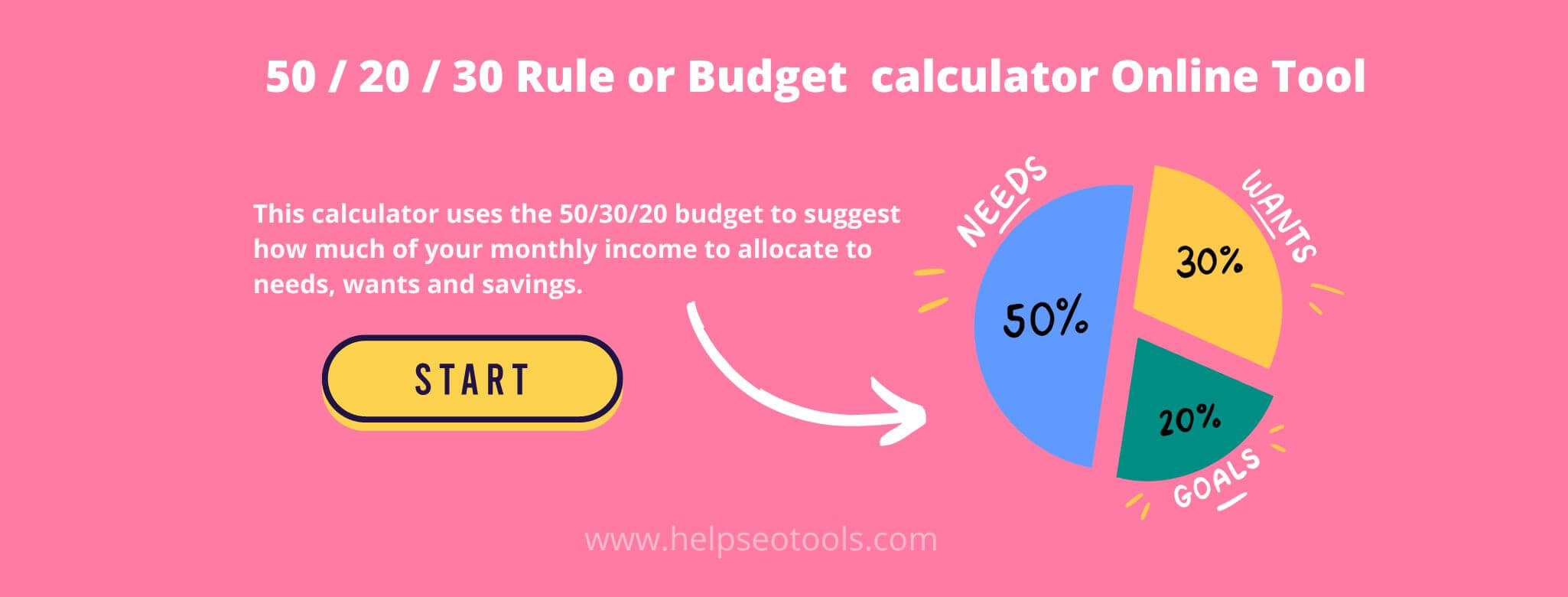

50 20 30 rule calculator | Budget calculator Online Tool

50 20 30 rule calculator help you to divide your income into 3 categories Necessities, wants, and savings. Just you need to enter your monthly or weekly earning income (after-tax) into this free budget calculator online tools. This 50-30-20 Rule calculator will categories your fund based on needs, wants, and savings.

50/30/20 Budget planner Find out how this budgeting approach applies to your money. Needs, Wants & Savings

- (50%) Necessities : $50

- (30%) Wants : $30

- (20%) Savings and Debt Repayment: $20

- Total income : $100

About 50 20 30 rule calculator Tool?

This 50 20 30 rule calculator is very simple to use and you can save a lot of money by using this 50 30 20 rule money management or can become a milliner. This budgeting calculator allows you to spread your income over three main categories, 50% of your income will be used for essentials, 30% will go for your wants, and the remaining 20% will be saved. The budgeting 50 20 30 was first developed by US Senator Elizabeth Warren. The 50 30 20 rule makes it easy for common people to save money and pay off debts.

How do you do the 50 20 30 budget rule?- 50% of your net income goes towards needs. This includes rent, utilities, food, transportation, insurance, etc.

- 20% of your net income is used for debt repayment.

- 30% of your net income can be spent on wants. This may include going out to eat, buying clothes, taking a vacation, etc.

How does the 50 20 30 rule distribute your income?

Our 50/30/20 calculator is designed to help you distribute your income into three recommended spending categories: 50% of your net income goes towards your needs, 30% goes towards your wants, and 20% is put on a savings and debt repayment plan.

Whether you're a college student, recent grad, or just trying to be more financially responsible, our 50/30/20 calculator helps you see how to maximize your discretionary spending. By understanding your income, spending habits, and savings goals, you can set up a budget that's personalized for you. By dividing your take-home income into suggested spending in three categories, you can see how to increase your spending in key areas and take a more active role in the financial decisions that impact your life.

The key to saving money is to spend less than you earn. The infographic above offers a calculator that will help you do just that. It breaks down your take- home income and suggests a plan of spending that would work well with your income. It's important to spend less than you earn to save money and set yourself up for debt repayment.

We hope you like our 50 20 30 rule calculator Tool. We know that it can be difficult to keep track of your take-home income and your spending habits, which is why we developed this calculator with the goal of increasing transparency in your spending. If you have any questions, please don't hesitate to get in touch with us sharing you Feedback.